The 10-Minute Rule for Property By Helander Llc

The 9-Minute Rule for Property By Helander Llc

Table of ContentsThe Greatest Guide To Property By Helander LlcThe Basic Principles Of Property By Helander Llc Top Guidelines Of Property By Helander LlcAbout Property By Helander LlcWhat Does Property By Helander Llc Do?The 3-Minute Rule for Property By Helander Llc

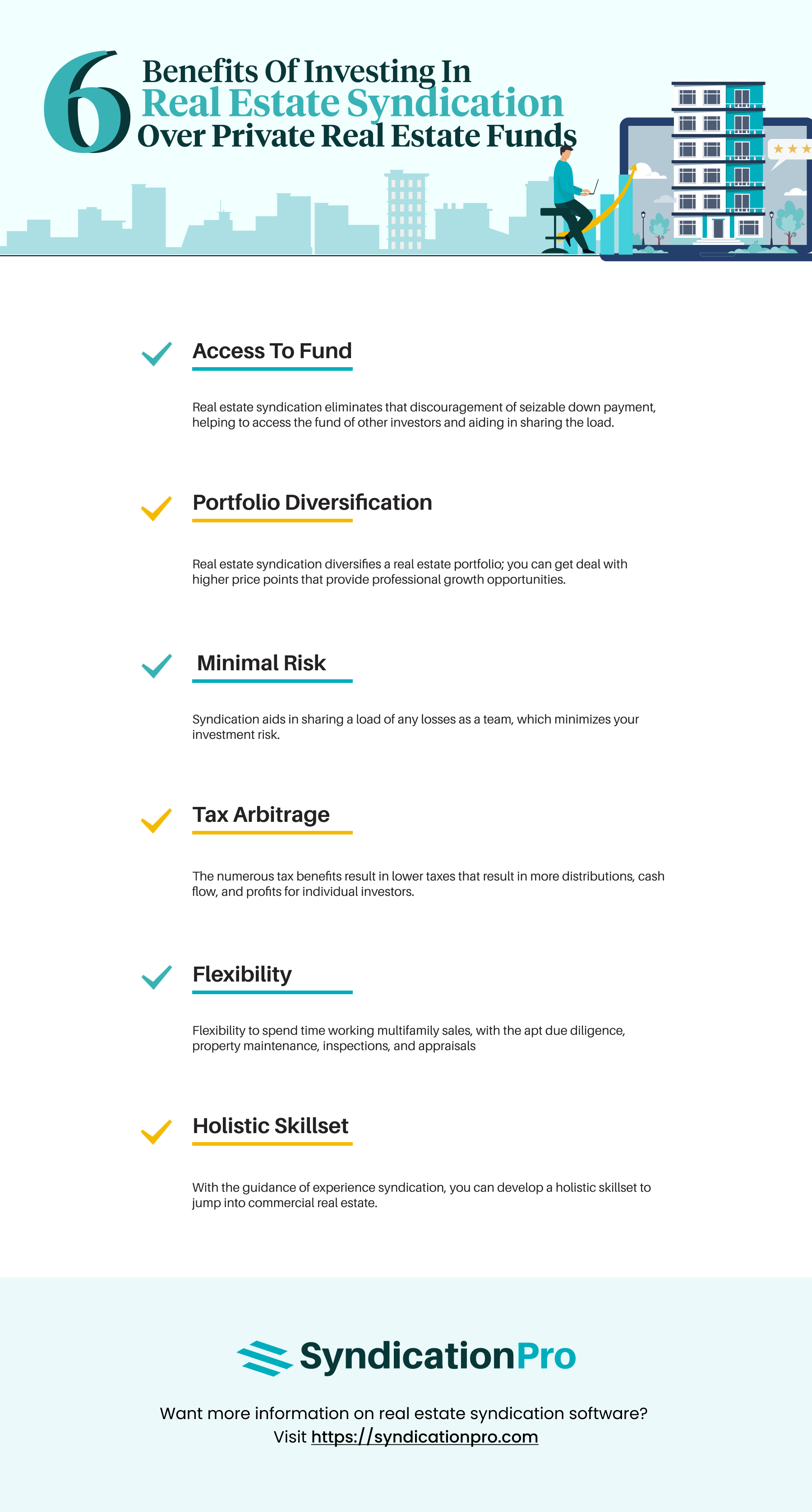

The advantages of investing in realty are various. With well-chosen assets, capitalists can appreciate foreseeable capital, outstanding returns, tax obligation benefits, and diversificationand it's feasible to leverage realty to construct wide range. Thinking concerning spending in realty? Right here's what you need to understand about property benefits and why actual estate is taken into consideration a great financial investment.The advantages of investing in actual estate consist of passive income, stable cash money flow, tax advantages, diversification, and utilize. Real estate investment depends on (REITs) use a method to invest in actual estate without having to have, operate, or finance residential or commercial properties.

Oftentimes, capital just strengthens with time as you pay for your mortgageand accumulate your equity. Investor can take advantage of many tax breaks and reductions that can save money at tax obligation time. As a whole, you can subtract the reasonable prices of owning, operating, and handling a residential or commercial property.

Property By Helander Llc Can Be Fun For Everyone

Realty worths tend to boost over time, and with a good financial investment, you can profit when it's time to sell. Leas additionally tend to increase gradually, which can bring about greater cash circulation. This chart from the Reserve bank of St. Louis shows typical home rates in the united state

The areas shaded in grey suggest united state recessions. Mean Sales Price of Homes Cost the United States. As you pay down a home mortgage, you build equityan property that's component of your total assets. And as you construct equity, you have the utilize to get more residential properties and enhance money circulation and riches much more.

Due to the fact that property is a concrete possession and one that can function as security, funding is conveniently offered. Realty returns differ, relying on factors such as place, asset course, and administration. Still, a number that many capitalists aim for is to beat the ordinary returns of the S&P 500what many individuals describe when they state, "the marketplace." The inflation hedging ability of realty comes from the positive partnership in between GDP growth and the demand for genuine estate.

The 8-Minute Rule for Property By Helander Llc

This, in turn, translates right into higher capital worths. Genuine estate tends to preserve the purchasing power of funding by passing some of the inflationary pressure on to renters and by including some of the inflationary pressure in the form of funding gratitude - Sandpoint Idaho real estate.

Indirect realty investing includes no direct ownership of a residential or commercial property or properties. Instead, you buy a pool along with others, where an administration company has and operates residential or commercial properties, or else has a portfolio of home loans. There are several manner ins which possessing genuine estate can secure against rising cost of living. Residential or commercial property values may rise greater than the rate of inflation, leading to funding gains.

Finally, residential or commercial properties financed with a fixed-rate funding will certainly see the his explanation loved one amount of the regular monthly mortgage repayments tip over time-- for example $1,000 a month as a fixed repayment will certainly end up being much less challenging as inflation erodes the purchasing power of that $1,000. Usually, a key house is ruled out to be a realty financial investment because it is utilized as one's home

The 7-Minute Rule for Property By Helander Llc

Despite the aid of a broker, it can take a couple of weeks of work just to discover the appropriate counterparty. Still, actual estate is a distinct property class that's easy to comprehend and can enhance the risk-and-return account of a financier's portfolio. By itself, realty provides cash money circulation, tax obligation breaks, equity structure, competitive risk-adjusted returns, and a hedge against inflation.

Purchasing realty can be an incredibly satisfying and rewarding endeavor, however if you resemble a whole lot of new capitalists, you may be asking yourself WHY you ought to be purchasing property and what advantages it brings over other financial investment opportunities. In enhancement to all the remarkable benefits that occur with purchasing actual estate, there are some drawbacks you need to consider also.

The Ultimate Guide To Property By Helander Llc

If you're looking for a method to purchase into the realty market without having to invest numerous countless bucks, look into our residential or commercial properties. At BuyProperly, we make use of a fractional possession model that enables capitalists to begin with as little as $2500. An additional major advantage of property investing is the ability to make a high return from buying, restoring, and marketing (a.k.a.

All about Property By Helander Llc

As an example, if you are billing $2,000 lease monthly and you sustained $1,500 in tax-deductible expenses each month, you will only be paying tax obligation on that $500 profit monthly. That's a huge distinction from paying tax obligations on $2,000 per month. The profit that you make on your rental system for the year is taken into consideration rental income and will be tired as necessary